Sep 30, 2024 Joel Hernandez

Super Obligations – are you keeping up?

With Single Touch Payroll and super fund data now being regularly reported to the ATO, the ATO is now able to quickly identify employers who appear to have outstanding Superannuation Guarantee (SG) obligations.

In March 2024, the ATO commenced a small nudge letter pilot, contacting a limited number of employers in relation to their SG obligations where the ATO identified possible non-compliance with the rules.

What are your Superannuation Guarantee Obligations?

Employers are required to fulfil their SG obligations by:

- paying the correct amount of superannuation guarantee for each eligible employee and

- paying the amount on time to the employee’s fund.

Superannuation guarantee is calculated by applying the SG rate to the employee’s ordinary time earnings (OTE). The minimum SG rate from 1 July 2024 is 11.5%. This is scheduled to increase to 12% on 1 July 2025. The maximum contribution base for the 2024-25 financial year is $65,070 per quarter, which means that workers’ earnings above this limit are only entitled to super up to the limit.

The meaning of OTE is defined under subsection 6(1) of the Superannuation Guarantee (Administration) Act 1992 (SGAA). OTE is the amount you pay employees for their ordinary hours of work including regular wages, some types of allowances, commissions, bonuses and leave entitlement payments.

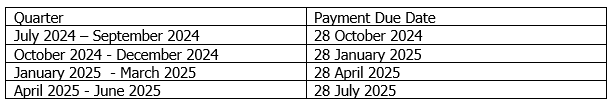

Superannuation guarantee contributions must be paid by the employer, and received by the employee’s funds by the 28th of the month following the quarter, and there is no grace period if you are late, regardless of how good your reason might be. The due dates for the 2024-25 financial year are as follows:

If you have not meet your SG obligations, you will need to lodge Superannuation Guarantee Charge (SGC) Statements and pay the SGC to the ATO. The SGC includes the SG shortfall, administration fee and nominal interest accrued from the due date to the date of payment. This means additional paperwork and cost which will not be tax deductible. In addition, the ATO can hold Directors personally liable for unpaid superannuation. All of this means that it is important that employers meet their SG obligations on time.

If you are late with your super payments, voluntarily disclosing this to the ATO promptly will be your best course of action. If the ATO discovers your late superannuation payments in a review of your affairs, it can apply “Part 7 penalties” which starts at 200% of the liability, with ATO discretion required to reduce or remit the 200% penalty.

For further information, please contact our tax and business services team.