Nov 25, 2024 RDL Financial Planning

What does President Trump mean for investors?

Key takeaways.

- We expect volatility to continue in the near-term.

- We continue to think politics is an unreliable driver of market performance and there is a much broader basket of market drivers.

- A key risk is a reacceleration in inflation.

- We think it is important to stick to investment processes, focus on portfolio diversification, and remain invested through any near-term volatility.

President Trump swept the polls in the US election.

After a highly contested campaign, Donald Trump won a resounding majority in the electoral colleges as well as the popular vote to be elected the 47th President of the United States. The Republican party also won a majority in the Senate and are on track for a similar majority in the House of Representatives.

Stocks soared with small caps outperforming on the prospect of lower taxes and less regulation. Treasury yields had trended higher ahead of the election, and jumped as the results became clear. But rates markets are uncertain about the economic outlook.

What a Trump Presidency and Republican Sweep means.

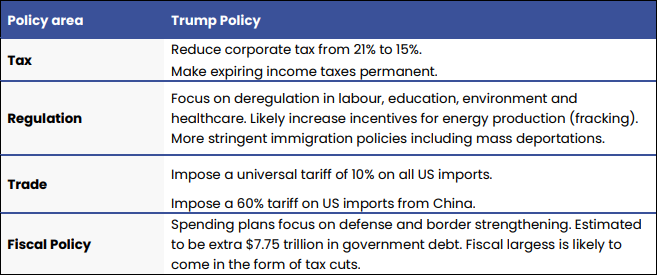

Table 1. Overview of Trump’s campaign policy

Source: Bloomberg LP, Ascalon.

Policy intentions do not equal market outcomes.

It is worth noting from the outset that policy intentions do not always equal market outcomes. Government policies are just one part of a broader basket of market drivers and, historically, factors such as interest rates and economic growth have tended to have much greater impact. Although there may be near-term volatility, policies take time to implement and may not be to the same extent as promised.

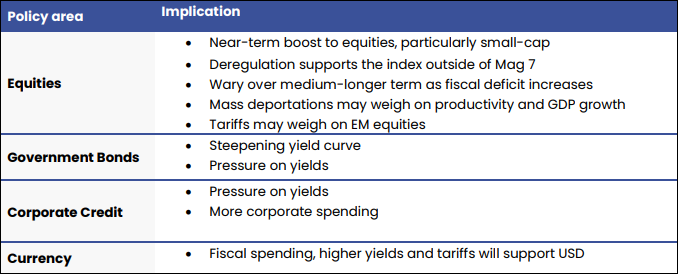

Some potential high level market implications.

The Trump tax policies are broadly seen as more favourable for equities. Similarly, corporate credit could perform better under Trump under lower taxes.

The US fiscal position looks set to worsen. For Trump, that comes down to reducing taxes as well as increasing spending. This could put upwards pressure on US Treasury yields. They have already soared in a so-called “Trump Trade” ahead of the election. But we think that monetary policy will be key driver of Treasury yields – and we expect the US Federal Reserve to continue to reduce rates over the near-term and medium-term. Higher bond yields, fiscal spending and tariffs all support the USD.

Table 2. Overview of asset class and economic implications:

Source: Bloomberg LP, Ascalon.

Inflation is the key risk looking ahead.

A key risk for investors is a reacceleration in inflation. Several of Trump’s policies are potentially inflationary. Tariffs, higher fiscal debt, mass deportations may all contribute to higher prices. That is already reflected in inflation expectations and poses a risk to Fed monetary policy and economic growth.

Chart 1. Inflation expectations have soared in the immediate aftermath of the election.

Source: Bloomberg LP, Ascalon.

What does it all mean for investors?

Market volatility increased in September and October ahead of November elections. That has so far given way to a relief rally immediately following the election outcome. We think it best to look through this near-term volatility. It is also worth emphasising policy positions are subject to change. It is not clear which policies would be prioritised. A Republican Senate and Congress does admittedly make it easier for Trump to fulfill his promises. However, we continue to expect politics to be an unreliable driver of market performance over the longer term. We think it is important to stick to investment processes, focus on portfolio diversification across equities and fixed income, and remain invested through any near-term volatility.

Disclaimer

NOTE: The information we present is general and does not constitute personal financial advice. Do not rely on this information without obtaining specific advice relevant to your circumstances.

Anyone reading this report must obtain and rely upon their own independent advice and inquiries.