Apr 8, 2025 RDL Financial Planning

Tarriffs and President Trump’s “Liberation Day”

Widespread tariffs exceed expectations

Markets have been widely anticipating President Trump’s “Liberation Day” on April 2. The erratic implementation of tariff policy from the Trump administration has made the business and investment environment very challenging. Equity markets slumped through March (see Table 1) on the uncertainty around US economic growth, the escalating trade war across the global economy, and potential retaliation to tariffs from other economies.

The actual tariffs announced were significant, and are likely to drag growth slower, while adding to inflationary pressures. We expect US trade policy to be a source of volatility for global investors in the near-term.

Why does President Trump want to implement tariffs?

President Trump has indicated that tariffs will have several key goals. These include:

- bringing manufacturing back to the US,

- responding to unfair trade policies from other countries,

- increasing tax revenue,

- incentivize crackdowns on migration and drug trafficking.

However, so far, he has largely used tariffs as a negotiating tool. With Canada, Mexico, and China, he has weaponized tariffs to force stricter border controls, to reduce illegal immigration and the smuggling of fentanyl into the US. Although the trade partners made some concessions, they did not appease the President and tariffs were still implemented after some delays.

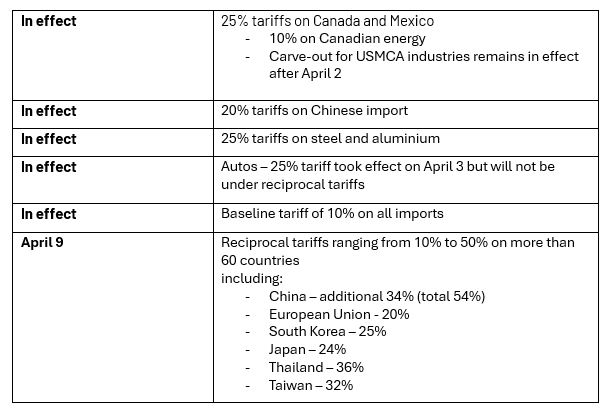

Table: Current tariffs as of April 3, 2025

To what extent do tariffs impact the economy?

There are many variables which may impact the extent of impact on the economy. But we expect tariffs will slow down growth and increase inflation. The uncertainty will probably slow business investment decisions, increase consumer prices and reduce consumer spending in the near term.

Over coming months, we will be monitoring the following areas to gauge the potential fallout from the tariffs.

- The extent of retaliation from trading partners. Tit for tat tariffs will be more inflationary.

- The impact on the USD. Currencies could act as a relieve valve as supply chains and prices are stretched due to tariffs.

- How central banks react. The Fed may be unable to cut rates in the near-term which could exacerbate a growth slow down.

- How fiscal policy responds. The Trump administration has campaigned on reducing government spending, which could also dampen growth in the near-term.

- How consumers respond. Higher prices and a slowing economy could lead households to retrench spending, reducing support for the US and global economy.

- Global recession is elevated.

- Closer to home, the RBA is under pressure to cut rates.

What does this mean for the investment outlook?

The investment outlook is particularly uncertain right now. Markets have been waiting for clarity on tariffs and other policies from the administration.

What actions can investors take?

While uncertainty is painful for investors, we have been pro-active in managing portfolios against volatility. Here are some actions that can help navigate volatility.

- Remain focused on the longer term. History shows that remaining invested and sticking to processes delivers long-term portfolio returns.

- Embrace a diversified portfolio. Our portfolio diversification has been critical in managing downside volatility through Q1 2025.

- Embrace dollar cost averaging. Over the long term this can help smooth out volatility and take advantage of near-term drawdowns.

- Build portfolio resilience. Allocating to assets with some downside protection can help within a diversified portfolio. We have been using high quality fixed income to help provide some resilience among our portfolios. Review your investment objectives.

We at rdl.financial planning welcome an opportunity to speak with you if you have questions or concerns with the state of markets and how this impacts your investments.