Sep 16, 2024 Andrew Low

Perplexed about HECS?

A HECS or HELP loan is a common occurrence among Australians going through the university system, giving them a helping hand to get through the challenges of university by providing a loan facility to pay the student contribution amount of their student fees. As the loan is not repayable until certain income thresholds are met, it usually takes a back seat to life’s other pleasures and priorities, but when you enter the workforce, you may be in for a shock.

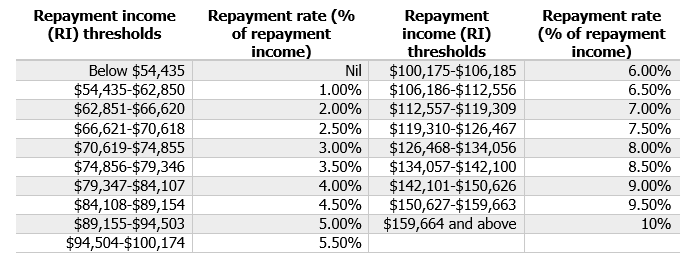

Compulsory repayment of your HELP loan is not required until your income meets the Repayment Income (RI) threshold for a given year – for tax returns being prepared for the 2024 financial year, the RI was $51,550. For the 2025 financial year, the thresholds and rates are summarised as follows:

For most people entering the workforce, when starting a new role with an employer, you will usually be asked to indicate whether you have a HELP loan, in which case your employer is obliged to withhold an additional amount from your wages. What many people do not realise however is that the Repayment Income can be affected by factors other than your wages, resulting in an increase in the HECS repayment.

Investment and other non-employment income

Employers are only obliged to withhold an addition amount on the gross wages that they pay to you, however the RI includes all elements of your taxable income e.g. interest, dividends, rental income, etc, not just wages. If the sum of these amounts (less any deductions) pushes your RI into the next repayment bracket, then your entire RI will be subject to a higher repayment rate.

Salary Sacrificed Amounts

Salary sacrifice arrangements occur where an employee agrees to forego a portion of their wages from their employer in return for other benefits. This is more common in industries where employers are exempt or partially exempt from paying Fringe Benefits Tax including:

- Healthcare

- Disability Support

- Public Benevolent Institutions

- Health Promotion Charities

While effective salary sacrifice arrangements do generally provide tax benefits for employees i.e. reducing taxable income, the grossed up amounts of the benefits received are still reported to the ATO as either Reportable Employer Super Contributions (RESC) or Reportable Fringe Benefits Amounts (RFBA). What catches many people out when they prepare their tax returns is that although these amounts are not directly taxable, they are however included in the Repayment Income calculation.

Employers are not obliged to withhold additional amounts for HELP loans for RESC and RFBA. This means that come tax time, you may need to fork out additional amounts of tax based on an increased Repayment Income.

Multiple Employers

Employers only withholding an additional amount for HELP debts based on the gross wages that they pay to you, not considering whether you have other sources of employment income. For example, if an individual worked two jobs paying $40,000 each per year, neither employer would withhold an amount for the HELP debt repayment. However when lodging their tax return, the individual would need to pay an extra $3,200 HELP debt repayment ($80,000 x 4%) based on their combined income from both jobs.

Tips

1. Be aware and ready for extra HELP repayments when you lodge your tax return. If you currently have a salary sacrifice arrangement with your employer, or have multiple jobs and have a HELP debt, you will most likely have an additional amount to pay when you lodge your tax return.

2. Make payments against your HELP loan before 1 June each year. HELP debts are ‘indexed’ yearly based on the balance of your debt on 1 June, so making a voluntary repayment before this will reduce the increase to your debt. Note that amounts withheld by your employer are not applied against your HELP debt until your tax return is lodged.

3. If you have fully paid off your HELP debt, inform your employer as soon as possible so they can cease withholding the additional amounts.

If you have any questions or are perplexed with your HECS/HELP debt, please contact one of our helpful RDL advisors.